Budget weekly template simple printable plan budgeting making guide planner beginner worksheets create worksheet monthly who stick beginners personal mydomaine

Table of Contents

Table of Contents

If you’re struggling to keep track of your expenses or finding yourself living paycheck to paycheck, it’s time to learn how to draw up a budget plan that works for you. Many people avoid creating a budget because they think it involves too much work or will restrict their spending. However, a budget can actually provide you with more freedom and help you achieve your financial goals faster.

The Pain Points Related to How To Draw Up a Budget Plan

One of the biggest pain points people face when creating a budget is the fear of losing control over their finances. We’re used to making spontaneous purchases or eating out whenever we feel like it, but a budget plan can limit these habits. Moreover, most people haven’t been taught how to handle finances, which leaves them feeling overwhelmed and unsure of where to start.

Answering the Target of How To Draw Up a Budget Plan

Keeping track of your finances is easier than you think. Start by making a list of all of your expenses, including rent or mortgage, utility bills, groceries, transportation, and any other necessary payments. Then, calculate your total expenses and compare that number to your total income. If your expenses are more than your income, it’s time to cut back on unnecessary spending or look for ways to increase your income.

Summary of Main Points Related to How To Draw Up a Budget Plan

In summary, learning how to draw up a budget plan can help you take control of your finances and reach your financial goals faster. A budget plan requires you to track your expenses, compare them to your income, and make necessary adjustments. Don’t let the fear of losing control stop you from creating a budget plan that works for you.

Creating a Budget Plan That Works for You

At first, creating a budget plan can be overwhelming, but it doesn’t have to be. Start by setting clear financial goals that you want to achieve in the short and long term. Do you want to pay off your debts, save for a down payment, or something else? Once you have a clear idea of your goals, you can start creating a budget plan that matches them.

Based on your goals, categorize your expenses into necessary and discretionary ones. Necessary expenses include rent, utilities, groceries, and transportation, while discretionary ones include eating out, shopping, and entertainment.

Based on your goals, categorize your expenses into necessary and discretionary ones. Necessary expenses include rent, utilities, groceries, and transportation, while discretionary ones include eating out, shopping, and entertainment.

Tracking Your Expenses

The next step is to start tracking your expenses. You can use a budgeting app, a spreadsheet, or a simple notebook to record your expenses. Make sure to include every single expense, no matter how small it is. At the end of each week, categorize your expenses and compare them to your budget plan. If you notice that you’re overspending in a specific category, look for ways to cut back.

Adjusting Your Budget Plan

Adjusting Your Budget Plan

Creating a budget plan is not a one-time event. You’ll need to adjust it regularly based on your expenses and income. If you get a raise or a side hustle, update your budget plan to reflect the change in your income. Similarly, if you have unexpected expenses, cut back on discretionary spending to stay on track.

Cutting Back on Discretionary Spending

Cutting back on discretionary spending doesn’t mean sacrificing your lifestyle completely. Look for creative ways to save money without compromising on the things you love. For example, instead of eating out at restaurants, plan a dinner party with friends where everyone brings a dish. Or, instead of buying new clothes every season, arrange a clothes swap party with your friends.

Question and Answer

Q1. How Often Should I Review My Budget Plan?

A1. Review your budget plan monthly and adjust it for any changes in your income or expenses.

Q2. Can I Still Have Fun on a Budget?

A2. Absolutely! You can still enjoy your life while on a budget. Look for free or low-cost activities such as picnics, hiking, or visiting museums on free admission days.

Q3. How Do I Stick to My Budget Plan?

A3. Make your budget plan a habit. Use a budget app to track your expenses or set reminders to check your budget plan regularly. You can also find an accountability partner, such as a friend or family member, to help you stay on track.

Q4. What Are Some Common Budgeting Mistakes?

A4. One of the most common budgeting mistakes is not tracking your expenses properly. Make sure to include every single expense, even the small ones. Another mistake is being too restrictive in your budget plan. Allow some room for discretionary spending, so that you don’t feel deprived.

Conclusion of How to Draw Up a Budget Plan

In conclusion, creating a budget plan is a crucial step towards achieving your financial goals. By tracking your expenses, categorizing them, and adjusting your plan accordingly, you can take control of your finances and live a fulfilling life without any financial worries.

Gallery

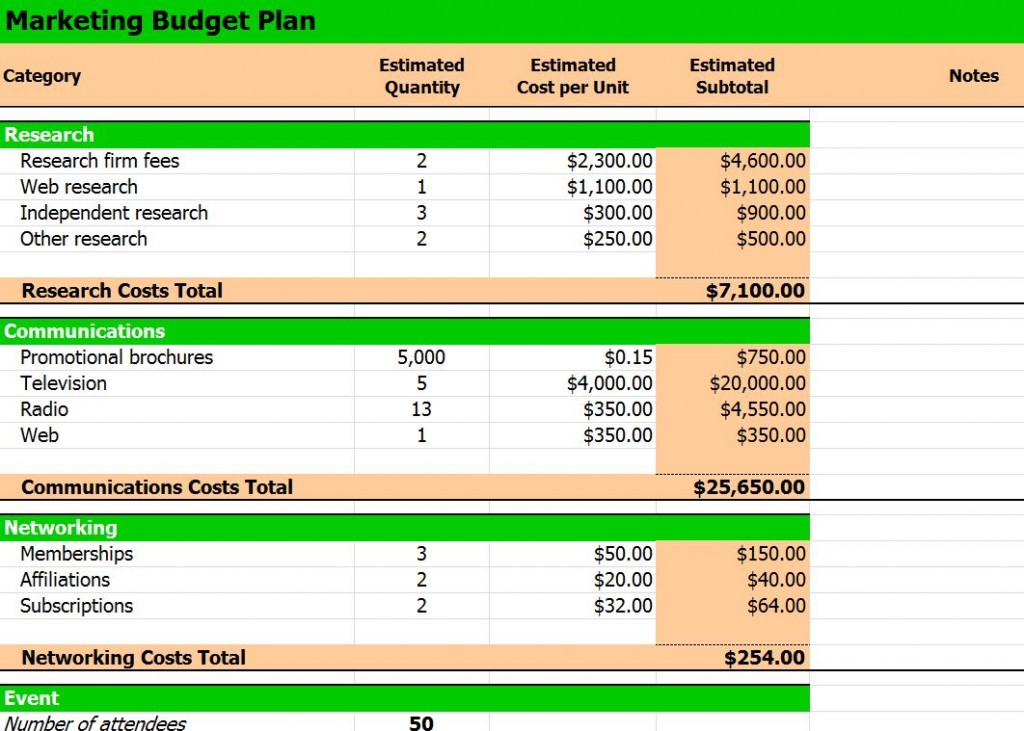

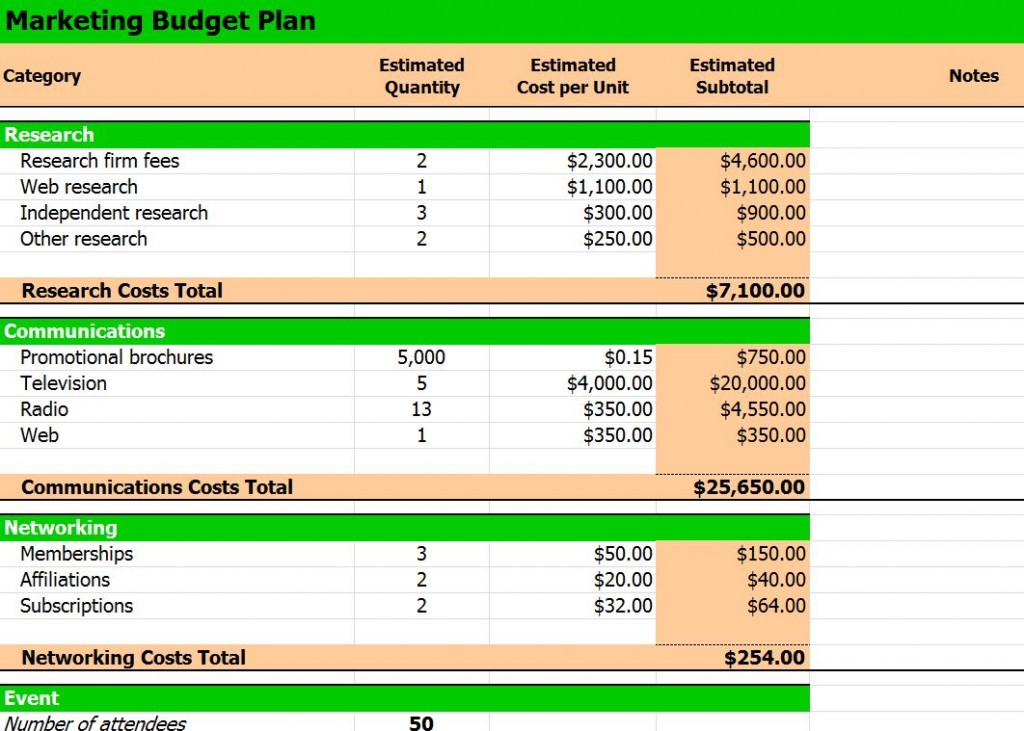

Excel Template Marketing Budget Planning

Photo Credit by: bing.com / plan marketing template excel budget project planning sample management templates business ms financial smartsheet timeline tips small heritagechristiancollege

How To Draw Up A Budget | City Press

Photo Credit by: bing.com /

Pin On Career & Financial Advice

Photo Credit by: bing.com / budget weekly template simple printable plan budgeting making guide planner beginner worksheets create worksheet monthly who stick beginners personal mydomaine

How To Create A Working Budget (with Examples) - WikiHow

Photo Credit by: bing.com / anggaran keuangan biaya liburan

5 Steps To Create An Effective Household Budget That Every Mom Should

Photo Credit by: bing.com / declutteringyourlife planner